1. Harness Solar Energy

Capture the sun's rays to generate clean power.

%20(19).png?width=800&height=500&name=CONTENT%20(800%20x%20500%20px)%20(19).png)

%20(17).png?width=500&height=312&name=CONTENT%20(800%20x%20500%20px)%20(17).png)

SUN VALLEY SOLAR | SINCE 2006

.png?width=1200&height=800&name=Untitled%20design%20(30).png)

.png?width=300&height=233&name=unnamed%20(3).png)

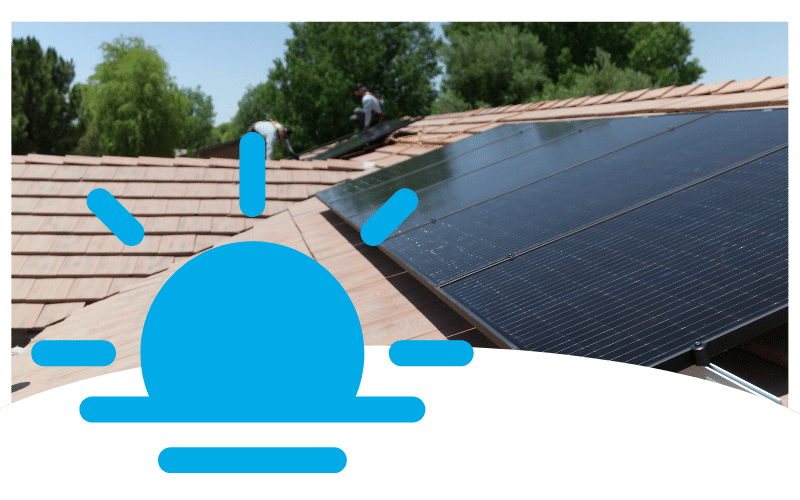

Sun Valley Solar Solutions is the only company in Arizona to become an APS QTI Qualified Technology Installer, SRP Preferred Solar Installer, Tesla Energy Premier Certified Installer, and Certified Amicus Member with NABCEP Certified PV Installation Professionals. Many solar companies buy their awards; we, on the other hand, let our authentic credentials and previous project history showcase our expertise. If you're looking for a company to trust with your project, you've come to the right place.

.png?width=300&height=233&name=unnamed%20(3).png)

Address: 1500 N Mill Ave, Tempe, AZ 85281

Address: 5575 11 Mile Corner, Casa Grande, AZ 85194

Address: 951 E Sawmill Rd, Flagstaff, AZ 86001

Everyone trusts Sun Valley Solar and PE Solar to install their solar panels, from global enterprises to counties and cities to your local utility company. We are the solar company everyone calls. Why? Because we are passionate about solar and committed to you every step of the way.

COMBINED YEARS EXPERIENCE

SOLAR PANEL PROJECTS INSTALLED

PASSIONATE HOURS WORKED

MW OF SOLAR PANELS INSTALLED

At Sun Valley Solar Solutions, we're not just Arizona's most trusted solar provider but also pioneers in making solar energy more accessible than ever. Thanks to our unique partnership with a credit union co-founded by our CEO, we're the only solar company in Arizona able to offer an exclusive financing deal to homeowners: solar loans at an incredible 0.99% APR.

Our People Make A Difference

Sun Valley Solar Solutions started with a simple idea: to harness Arizona's sunshine to power our community. Then, we merged with PE Solar, combining our love for technology and a sustainable future to bring you top-notch solar solutions. We're all about empowering your home with clean, reliable energy while keeping you in the loop every step of the way.

An Investment in Quality

Choosing Sun Valley Solar means investing in the best for your home. We pick only the most reliable solar panels known for their long-lasting performance. Our team, right here in Arizona, is dedicated to installing your system with care and precision. It’s not just about going solar; it’s about upgrading your home with energy that saves money and the planet.

At Sun Valley Solar, we bring our expertise directly to your doorstep. From custom solar panel installations to meticulous maintenance, our range of services is designed to ensure your solar experience is seamless and satisfying. Our team, equipped with years of experience and a deep understanding of solar technology, is committed to providing solutions that are not only efficient but also tailored to your unique needs. Whether it's a residential setup or a commercial project, we handle every aspect with precision and care, guaranteeing optimal performance and lasting results. With Sun Valley Solar, step into a brighter, more sustainable future with confidence.

Custom solar setups to perfectly fit your home's energy needs and design.

Learn More

Tailored solar solutions for businesses, enhancing efficiency and eco-friendliness.

Learn More

Dependable maintenance and repair to keep your home solar system running smoothly.

Learn More

Reliable service and maintenance for commercial solar systems, ensuring optimal performance and longevity.

Learn More

Our commitment to quality and sustainability is more than just a promise—it's a reality experienced by our countless satisfied customers. But don't just take our word for it. See what our customers have to say about making the switch to solar with Sun Valley Solar and PE Solar. Each solar journey is unique, but the satisfaction shared by our customers is a common thread.

.svg.png?width=1991&height=624&name=Pepsi_logo_(2014).svg.png)

Cut Your Costs with Solar Power

Imagine keeping more money in your pocket each month. Solar energy makes this possible by significantly reducing your energy bills. By harnessing the sun's power, you're not just lighting up your home but also your finances. With our efficient solar solutions, you can enjoy the freedom of lower utility costs, turning the abundant Arizona sunshine into real savings. Don't wait to start saving – the sun is shining on your opportunity to cut costs now!

Be the Master of Your Power

Take control of your energy future with solar power. No more relying on unpredictable grid power or worrying about outages. Our solar solutions empower you with energy independence, ensuring your lights stay on and your life remains uninterrupted, even when the grid goes down. Experience the peace of mind that comes from self-sufficiency. It's not just about power; it's about empowerment. Make the smart switch to solar today and become the commander of your energy destiny.

Sun Valley Solar has been a go-to source for everything solar, earning a reputation as the local expert in Arizona's solar landscape. Our appearances on numerous news stations highlight our in-depth knowledge and underscore our commitment to educating and informing the community about the benefits and advancements in solar technology.

Embark on a journey of discovery into the world of solar energy. This incredible technology harnesses the sun's abundant power, offering an eco-friendly and cost-effective solution for your energy needs. Solar panels convert sunlight into electricity, reducing reliance on conventional power sources and fostering a sustainable future. Whether it's powering homes, offices, or entire communities, solar energy is a clean, renewable resource that's reshaping how we think about and use power.

Capture the sun's rays to generate clean power.

Convert solar energy into usable electricity.

Utilize solar electricity for daily needs at home or work.

Embark on your solar journey with Sun Valley Solar. Our seamless process ensures a hassle-free transition to solar energy, from initial consultation to ongoing monitoring. Experience the ease of going solar with our comprehensive services.

Understand and Maximize Your Savings: Our team conducts a detailed assessment, exploring all available incentives tailored to your location, from utility rebates to state and federal credits, ensuring you get the best financial benefits.

Customized Solar Solutions: We design a solar system that aligns with your energy needs and property specifics. Sun Valley Solar takes charge of the entire design and permitting process, ensuring a system that optimizes energy production and savings.

Expert Installation and Setup: Our skilled team oversees every aspect of the solar panel installation, ensuring high standards and efficiency. We handle everything, providing a smooth transition to a solar-powered home or business.