The federal solar investment tax credit, more simply known as the ITC, has been a significant factor in large-scale commercial solar adoption over the last decade. Going solar and claiming this lucrative incentive allows businesses to offset investment costs while significantly reducing operating expenses. This win-win scenario was significantly boosted when Congress passed a 2-year extension of the current 26% ITC credit through 2022. Let's take a closer look at what that means for commercial solar.

The New Tax Credit RAMP-DOWN Schedule

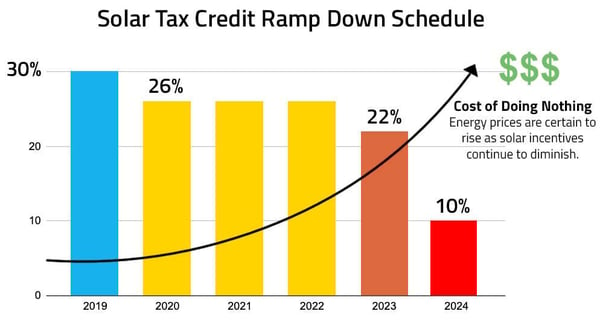

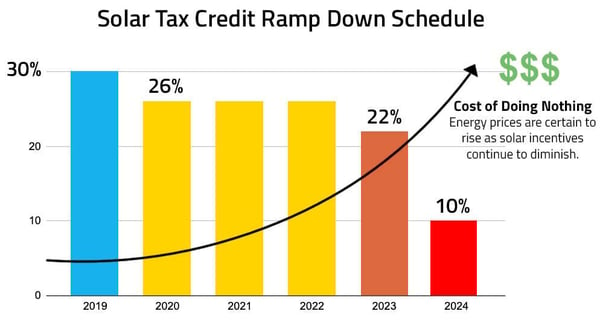

2019 marked the end of the solar ITC's long-standing 30% rate, which had been in place for over a decade. In 2020, the ITC began a planned ramp-down schedule, dropping to 26%, with the next step down to 22% initially scheduled for January 1, 2021. At the last minute, Congress decided to pause the ITC's planned reduction for two years as part of the stimulus package signed into law in December 2020. The ITC will hold the current 26% rate through 2022 in the new schedule. In 2023, the ITC reduced to 22% before dropping to a permanent 10% for commercial projects by January 2024.

So what does all this mean in the short term? The big takeaway is that if your company has been considering solar and cares about achieving the maximum ROI through incentives, the extended ITC schedule just gave you a slight breather.

But stay comfortable. As we get closer to the next step down, demand and solar installation backlogs will certainly grow. Most solar installers have reported longer than usual permit wait times and increasingly packed install schedules since the ITC's first ramp-down step took effect in January 2020. What's more, commercial solar projects are complicated and take time. So, if you want to lock in these lucrative incentives, don't wait. The sooner you start your commercial solar project, the better.

Updated Safe Harbor Timeline

Naturally, with the 26% tax credit extension, the safe harbor guidelines for new solar projects are also extended by two years. As with the previous schedule, the safe harbor provision of the ITC allows companies going solar to preserve the tax credit of the current year by either paying 5% of the total project costs or beginning work of a "significant nature" (usually recommended for larger systems only) before the next scheduled step down.

With the new extension, the following safe harbor dates should be followed:

- For the 26% tax credit, your system must be 5% paid or under construction of a "significant nature" by the end of 2022 and commissioned by the end of 2025.

- For the 22% tax credit, your system must be 5% paid or under construction of a "significant nature" by the end of 2023 and commissioned by the end of 2025.

- Systems 5% paid or under construction of a "significant nature" after the above deadlines will qualify for the 10% solar tax credit.imele

30% Rate Unaffected For Those Who Safe Harbored Before 2020

For organizations that took advantage of the ITC's safe harbor provision before the first scheduled step-down, the time frame for the full 30% ITC benefit has stayed the same. To qualify for the full 30%, your project needed to have begun construction — or was paid 5% of the total cost — before January 2020, and it must be placed into service by the end of 2023.

IMPORTANT: Please be aware that these dates are subject to change as future congressional moves impact the ITC. Sometimes, blogs have longer lives than legislation. As such, we always recommend that you check with a qualified solar installation company to determine incentive programs' current status and critical dates.

More help has never been available to businesses that want to offset the rising energy cost with their solar power plant. Contact our commercial solar team to find out what’s available for your business. Act now before the 26% ITC and other incentives expire!