One of the many factors contributing to the massive expansion of solar energy over the last decade is the 30% federal solar investment tax credit, known more simply as the ITC. In short, the ITC allows businesses that go solar to offset up to 30% of the purchase price through a federal tax credit. Sadly, though, this great program is about to get much smaller.

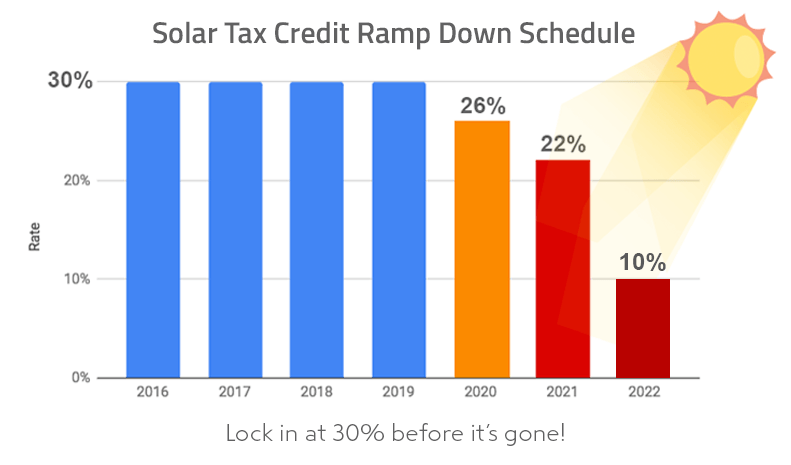

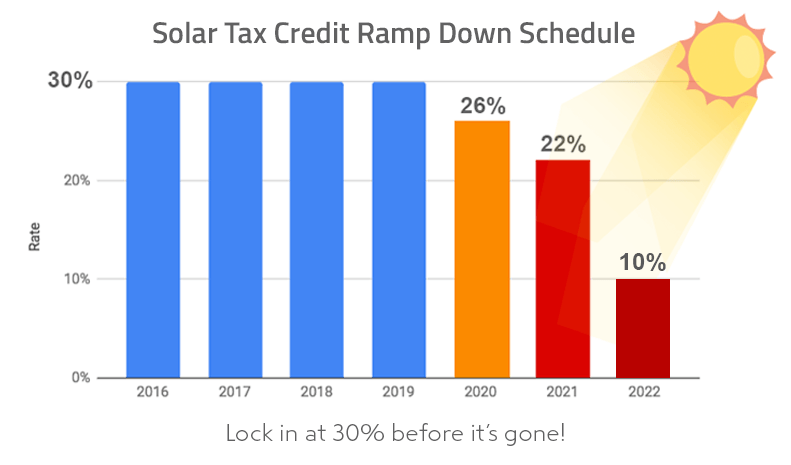

Two thousand nineteen marks the end of the current 30% rate. In 2020, the ITC began ramping down as part of a three-year decline toward a permanent 10% credit for commercial solar projects beginning in 2022. So, if you want the fastest and biggest return on your commercial solar investment, this is the year to act. Given the demand for solar installers in this final 30% year, the sooner you start your commercial solar project, the better. Below, we cover important parts of the ITC and explain why acting now will give you the best return on your commercial solar investment.

What is the ITC?

First established as part of the Energy Policy Act of 2005, the solar ITC is a dollar-for-dollar tax credit that allows organizations to reduce the gross cost of the solar system by 30%. To qualify, the business must have a tax liability upon filing. In other words, if the business owner receives money back from their tax return, the credit will not be applied for that year and will roll forward to the next.

The incentive's original expiration date was extended twice, with the most recent extension in 2016. That extension detailed the current ramp down schedule that decreases the tax credit each year until permanently remaining at 10% starting in 2022 for commercial solar projects. With our current political climate, it is unlikely that Congress will offer another extension, so we encourage you to capitalize on the 30% rate NOW before it's gone.

What is the RAMP-DOWN schedule?

The current 30% rate is in place through the end of 2019, so this is the last year to reap the maximum return from this lucrative incentive program. In 2020, the ITC reduces to 26% and drops to 22% in 2021. From 2022 onward, the commercial ITC will remain at 10% permanently for commercial customers, ending completely for homeowners.

2019 just started, so I have plenty of time, right?

Eleven months seems like a long time, so it's natural that your business has plenty of time to claim the 30% solar tax credit. But going solar involves many steps and coordination with outside entities for engineering, permitting, and commissioning. Plus, reputable installers like Sun Valley Solar Solutions are already seeing tighter installation schedules than normal as businesses rush to make the 30% deadline.

At Sun Valley Solar, we always say, "The best day to go solar was yesterday," with each passing day, that hyperbole holds more and more truth. With the 30% ITC ending, 2019 is surely the most important year for solar in more than a decade. Contact a member of our commercial solar team to schedule a consultation and start your solar project today!